An e-Invoice is a digital representation of a transaction between a supplier and a buyer. e-Invoice replaces paper or electronic documents such as invoices, credit notes, and debit notes.

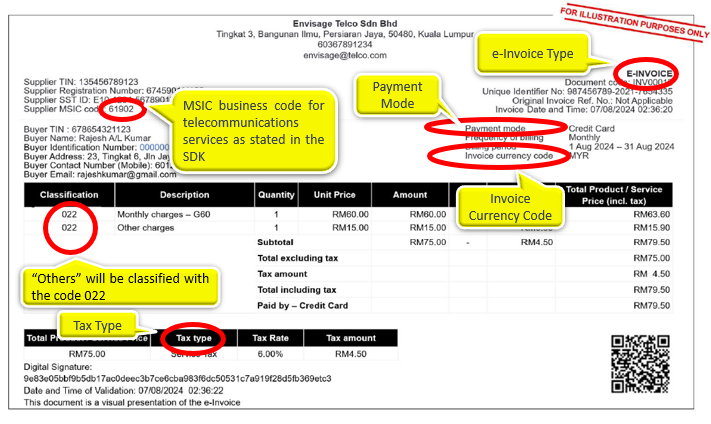

An e-Invoice contains the same essential information as traditional document, for example, supplier’s and buyer’s details, item description, quantity, price excluding tax, tax, and total amount, which records transaction data for daily business operations.

Benefits of e-Invoice

The implementation of e-Invoice not only provides seamless experience to taxpayers, but it also improves business efficiency and increases tax compliance. Overall benefits include:

The figure below demonstrates an overview of the e-Invoice workflow from the point a sale is made or transaction is undertaken, and an e-Invoice is issued by the supplier via MyInvois Portal or API, up to the point of storing validated e-Invoices on IRBM’s database for taxpayers to view their respective historical e-Invoices.

e-Invoice Implementation Timeline

e-Invoice will be implemented in phases to ensure smooth transition. The roll-out of e-Invoice has been planned with careful consideration, taking into account the turnover or revenue thresholds, to provide taxpayers with sufficient time to prepare and adapt to the e-Invoice implementation.

Below is the e-Invoice implementation timeline:

55 Required Fields for e-Invoice

How does AutoCount e-Invoice Platform (AIP) works?

Developed in effectual of the official LHDN e-Invoice Software Development Kit (SDK), AutoCount AIP bridges the gap between businesses and the LHDN, enabling direct submission of e-Invoices to the LHDN MyInvois system through the familiar AutoCount software interface. This functionality covers generation of Standard, Consolidated, and Self-Billed e-Invoices. Soon, users will have the capability to utilize Peppol standard invoicing for their transactions, enhancing interoperability within the Peppol ecosystem.

Standard e-Invoice

- Generate e-Invoices using AutoCount Accounting or Cloud Accounting, then upload them to the AutoCount e-Invoice Platform (AIP) for submission to the LHDN MyInvois system.

Consolidated e-Invoice

- Businesses in retail and F&B can easily generate consolidated LHDN compliant e-Invoices for B2C transactions and directly upload them to LHDN from AutoCount POS.

- Retail or F&B business owners running multiple stores in different locations able to consolidate e-Invoices by utilizing POS Solution. With a simple click, invoices from each outlet can be generated and consolidated while complying with LHDN regulations.

- Customers can simply scan the QR code printed on the receipt and enter details to request an e-Invoice, making the process even simpler.

- Once customer filled in their details and submitted the request, it will then prompt the AutoCount AIP to generate e-Invoice.

Self-Billed e-Invoice

- Self-billed e-Invoices can be particularly cumbersome for businesses engaged in high-volume activities, such as international procurement or those incurring varied expenses like commissions paid to agents, dealers, or distributors.

- With the AutoCount e-Invoice solution, effortlessly transfer details from purchase invoices and payment vouchers to self-billed e-Invoices, eliminating the need for manual entry and saving time!

WHY choose AutoCount for your LHDN e-Invoicing needs?

Seamless Integration and LHDN Compliant

Experience seamless integration between AutoCount software and the LHDN MyInvois system, enhances operational efficiency, accuracy, and full compliance with the latest LHDN regulations.Streamlined Processes, Swift Operations, and Efficient Outcomes

Streamline the collection of customer information, such as TIN number and company details, with a single click or through a quick QR code scan. With the retry mechanism in AutoCount e-Invoice Platform, the invoices will be resubmitted if LHDN MyInvois System is down, significantly reducing manual effort and ensuring swift and efficient operations.Maintain accuracy and data integrity

Appoint an approver to supervise your team's e-Invoice generation and submission processes, ensuring the accuracy and integrity of data prior to direct transmission to the LHDN MyInvois System, significantly reduces concerns over errors.AutoCount Solution with LHDN e-Invoice

Inquiry - AutoCount Solution with LHDN e-Invoice